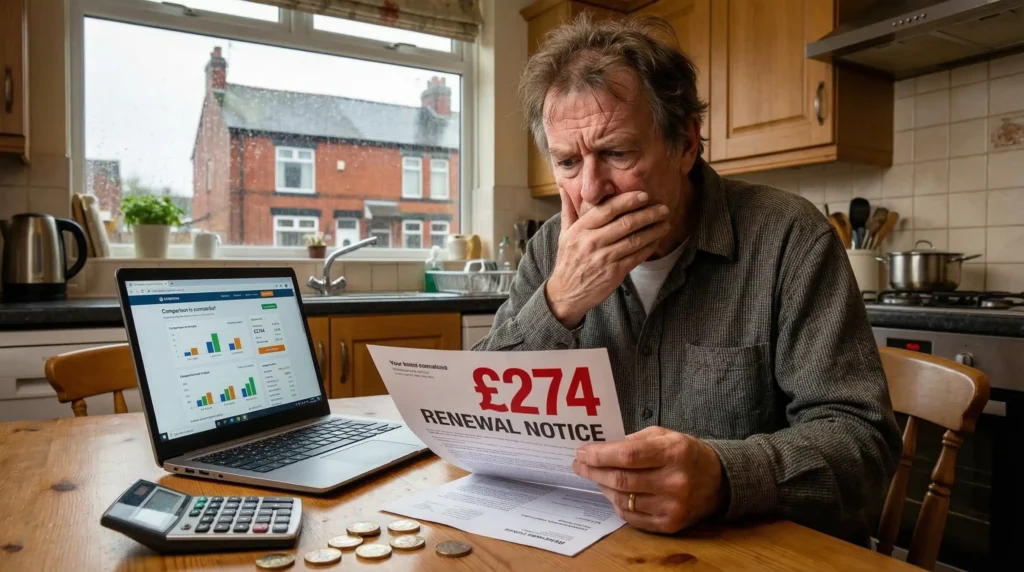

If your home insurance UK renewal letter made you do a double-take this year, you’re not imagining things. Prices have gone absolutely mental. The average homeowner now pays £274 a year—that’s 60% more than what we paid in 2023.

Buildings insurance alone jumped 25% in just twelve months. London got hit worst with a 69% increase. Even if you think you can’t afford to switch, you can’t afford not to. Let me explain what’s happening and how to fight back.

Table of Contents

Why Home Insurance UK Prices Exploded in 2025

Multiple things hit us all at once, and insurance companies passed every single cost straight to us.

Storms absolutely battered the UK in 2024. Insurers paid out £585 million just for weather damage. When they lose that much money, they make it back by charging everyone more the next year. Doesn’t matter if your house was fine—you’re still paying for everyone else’s flood damage.

Building Costs Went Through the Roof

Rebuilding a house costs 21% more than it did two years ago. Timber, steel, cement—everything’s more expensive. Labour costs skyrocketed because there aren’t enough skilled builders to go around. When a claim happens, insurers pay these inflated prices, then jack up everyone’s premiums to cover it.

Insurers Started Playing Hardball

Some insurance companies pulled out of risky areas completely—flood zones, coastal regions, anywhere they lose money. Fewer companies competing means higher prices for everyone left behind. Classic supply and demand, except we’re the ones getting squeezed.

Who’s Really to Blame for the Price Hikes

Honestly? A bit of everything. Climate change means more extreme weather. Brexit messed up supply chains for building materials. COVID created labour shortages that still haven’t sorted themselves out.

But here’s what really winds me up: insurers don’t reward loyalty anymore. They quote new customers lower prices and expect existing customers to just accept massive renewal increases without shopping around. It’s basically a tax on laziness.

Cheapest Home Insurance UK Providers Right Now

Not all home insurance UK companies charge the same. Here’s who’s actually competitive on price:

AA and Allianz – Under £15/Month

These two consistently come up cheapest on comparison sites. AA starts from about £12 monthly, making them worth checking first.

Admiral – 4.6 Stars on Trustpilot

Admiral has over 130,000 reviews and people rate them highly for both price and service. They’re not always cheapest, but they’re reliable.

Aviva – Good All-Rounder

Aviva offers solid coverage at reasonable prices. They also own Quotemehappy.com, which is their budget-focused brand if you want bare-bones cover.

Churchill and Direct Line – About £190

Both sit in the mid-range price bracket but offer decent coverage. Remember Direct Line won’t show up on comparison sites—you have to quote directly with them.

8 Ways to Slash Your Home Insurance UK Bill

- Buy 29 Days Before Renewal – This is weirdly specific, but research proves it works. People who buy home insurance UK policies 29 days early pay £189 on average. Wait till renewal day and you’ll pay £227—that’s £38 wasted for doing nothing.

- Compare Every Single Year – Loyalty costs you money. Period. Insurers assume you won’t bother switching, so they hike your price every year. Spending 15 minutes comparing could save you hundreds.

- Pay Annually Instead of Monthly – Monthly payments include interest charges that add up fast. If you can afford to pay the full year upfront, you’ll save £30 to £50 just by avoiding those fees.

- Increase Your Voluntary Excess – Tell them you’ll pay the first £250 or £500 of any claim yourself. Your premium drops immediately. Just make sure you actually have that money saved in case something goes wrong.

- Check Your Rebuild Sum – Most people overestimate how much it would cost to rebuild their house. Get an accurate figure (not your house’s market value—that’s different). Lowering this number can cut your premium.

- Install Better Security – Upgraded locks, burglar alarms, security cameras. Insurers reward homes that are harder to burgle. Some give you 5-10% discounts for proper security systems.

- Bundle Buildings and Contents Together – Most companies offer discounts if you insure both with them instead of splitting between providers. Can save 10-15% compared to buying separately.

- Don’t Claim for Small Stuff – Every claim pushes up your future premiums. If something costs £150 to fix and your excess is £100, claiming only saves you £50 but could cost you hundreds in higher premiums over the next few years.

Why Your Postcode Costs You More

Where you live absolutely hammers your price. London homeowners pay way more because of higher crime rates and expensive repairs. Coastal areas cost more because of flood risk.

Northern Ireland got hit with a 31% increase this year—the highest in the UK. If you live somewhere insurers consider “high risk,” you’re stuck paying extra even if nothing’s ever happened to your house.

Check the official flood risk assessments if you want to understand why your area costs more. At least then you’ll know what you’re dealing with.

What to Do Before Your Renewal

Don’t just accept that renewal letter. Set a reminder in your phone for 29 days before your policy ends. That’s your sweet spot for getting the best home insurance UK prices.

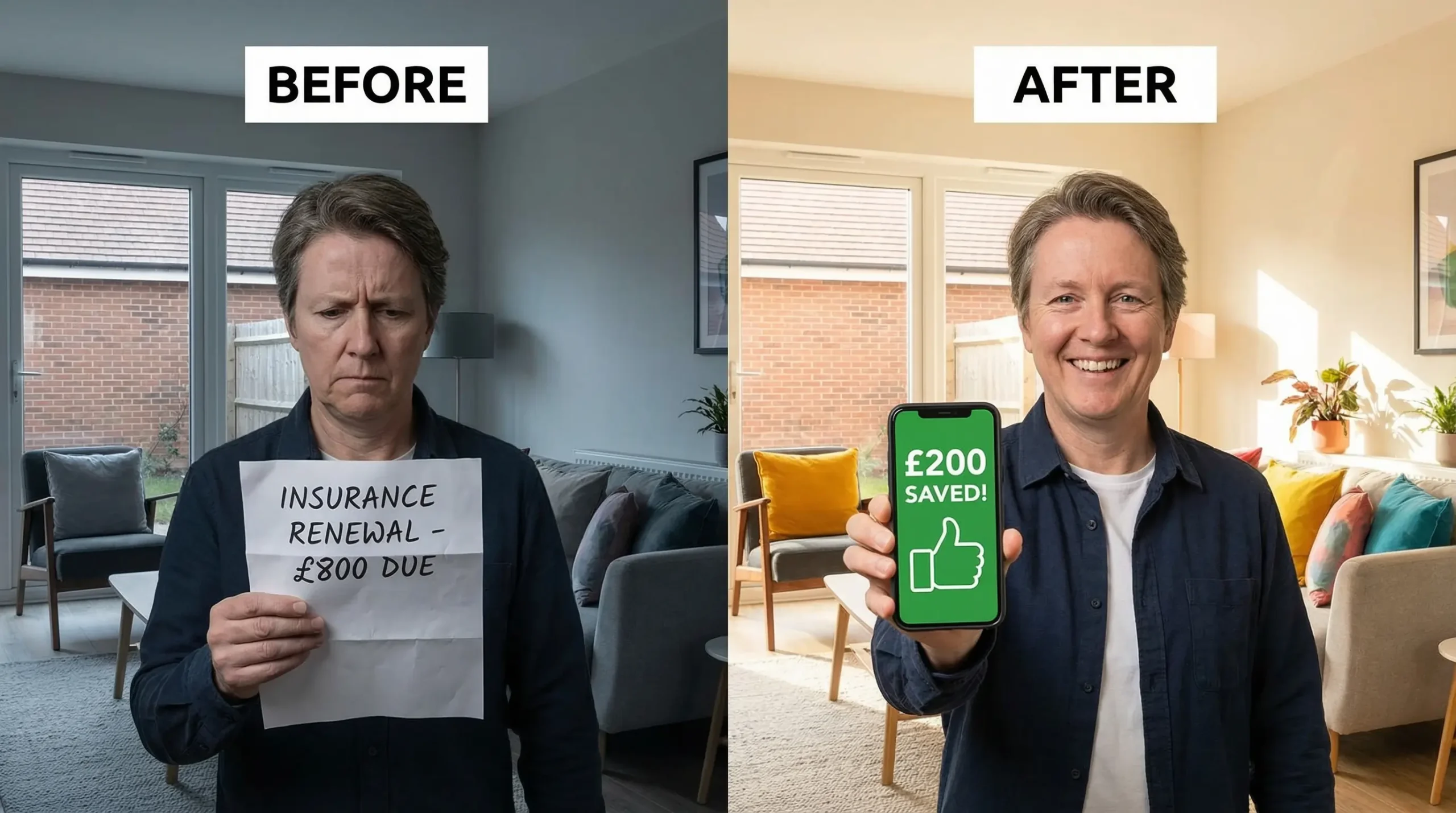

Use at least three comparison sites—Compare the Market, Confused, GoCompare. They all show slightly different providers and prices. Takes 20 minutes total but could save you £200+ a year.

Make sure you’re comparing like-for-like coverage. Cheaper isn’t always better if it doesn’t cover what you need. Read what’s included, especially for things like accidental damage, garden cover, and personal possessions away from home.

Stop Overpaying for Home Insurance UK

Yes, prices went up for everyone. But that doesn’t mean you have to accept whatever your current insurer throws at you. The companies charging loyal customers 60% more than three years ago are counting on you not bothering to switch.

Prove them wrong. Get your renewal letter, mark your calendar for 29 days before it expires, spend 20 minutes comparing quotes, and switch to whoever’s cheapest. Your future self will thank you when you’re not throwing away an extra £100 for absolutely nothing.

The home insurance UK market is brutal right now, but you’ve got more power than you think. Use it.

Why is my home insurance so expensive in 2025?

Storms destroyed thousands of homes last year, and insurers paid out millions. Now they’re charging us more to get that money back. Additionally, the cost of builders and materials has increased significantly. Fewer insurance companies want to cover risky areas, so prices have gone up everywhere.

What’s the difference between buildings insurance and contents insurance?

Buildings = the house itself. Walls, roof, kitchen, bathroom. Contents = your stuff. TV, sofa, clothes, and a laptop. Tree hits your roof? Buildings pay. Burglar steals your TV? Contents pay.

Should I buy buildings and contents insurance together or separately?

Together. You save about £27 a year, and you don’t have two companies fighting over who pays when something breaks. Just one company, one bill, less hassle.

Is it cheaper to pay monthly or yearly for home insurance?

Yearly. Monthly costs more because they charge interest. You end up paying £30-50 extra just for splitting it into monthly chunks. Pay once if you can afford it.

Can I get home insurance if I live in a flood risk area?

Yeah, but it costs more. There’s a government scheme called Flood Re that helps if your house was built before 2009. Otherwise, you need a specialist insurer who actually covers floods.

What can’t I claim on home insurance?

Old stuff that breaks from age. Your 20-year-old boiler dying isn’t covered. Damp that’s been there for ages. Things you broke on purpose. Stuff stolen from your garden. Read your policy so you know what’s out.

Do insurance companies have to charge me the same as new customers now?

Yes. Since 2022, they can’t rip off loyal customers anymore. Your renewal has to match new customer prices. But still shop around because other companies might be cheaper.

How do insurance companies calculate my premium?

Where you live matters most. High crime area? You pay more. Flood zone? More expensive. They also check rebuild costs and your claims history. More claims = higher price.

What’s accidental damage cover, and do I need it?

Covers stupid mistakes. Wine on carpet, dropped laptop, football through the window. Not included in basic cover. Get it if you have kids or you’re clumsy. Skip it if you’re careful.

Will my premium go down if I install a burglar alarm?

Usually drops 5-10%. Same with better locks and cameras. Insurers like houses that are harder to rob. Just tell them you installed it, or they won’t lower your price.

Should I claim for small damage or just pay for it myself?

Pay it yourself if it’s under £200. Claims make your future premiums go up for years. Saving £100 now might cost you £200 extra later. Only claim big stuff.

What happens if I underestimate my rebuild value?

You get screwed. Say it costs £200k to rebuild, but you told them £150k? They’ll only pay three-quarters of your claim. Use a proper calculator. Don’t guess.