Digital Insurance Explained: A Simple Guide for First-Time Buyers: Nearly half of consumers today buy insurance through digital channels. This shift to digital insurance is happening rapidly, and it’s transforming how we approach protecting our homes, cars, and health. Digital insurance refers to the technologies that have transformed how insurance companies operate and serve their customers.

Table of Contents

If you’re new to buying insurance, digital options offer speed, easy access, and user-friendly interfaces. In fact, digital insurance allows you to manage your policies, claims, and billing online without needing in-person appointments or paper documents.

Furthermore, these services can help make insurance more available and affordable for people in remote areas or those with lower incomes. With over 1,000,000 visitors in the last five years to digital insurance resources, it’s clear that many people are looking to understand these new options. In this guide, we’ll explain everything you need to know about digital insurance as a first-time buyer.

What is Digital Insurance and Why It Matters

“Digital insurance refers to a digital-first approach to running an insurance business, where technology becomes a core element of operations and customer service.” — Intellias, Insurance technology consulting firm with extensive experience in digital transformation

## What is Digital Insurance and Why It Matters

Definition of digital insurance

We can say it’s a technology-first approach that delivers insurance products completely through online channels. Simply put, it’s the shift of traditional insurance services to digital platforms. Digital insurance allows customers to buy, manage, and claim insurance policies through websites, mobile apps, and other digital tools without needing to visit an office or talk to an agent.

According to a 2023 to the current year survey, about 40% of Europeans already use digital insurance services. This number continues to grow as more people discover how easy it is to handle insurance matters online.

How it differs from traditional insurance

Traditional insurance typically involves a complicated multi-step process with paperwork, in-person meetings, and phone calls. Unlike traditional methods, digital insurance offers:

- Simplified Process: It requires no physical form-filling or branch visits

- Speed: Claims are processed much faster through digital channels

- Accessibility: 24/7 service instead of being limited to office hours

- Communication: Clear, jargon-free language versus confusing insurance terms

- Cost: Generally less expensive due to lower operational costs

Traditional insurance relies on agents and manual processes, whereas digital insurance uses automation, data analytics, and AI to streamline everything from purchasing to claims.

Why is it gaining popularity among first-time buyers

Digital insurance is winning the hearts of first-time buyers primarily because it matches how we shop for everything else today. A 2025 report shows that 64% of Digital Natives (people born after 1975) believe insurance should be overwhelmingly purchased and managed online.

Additionally, young consumers are twice as likely to prefer buying insurance digitally rather than talking to an agent. This preference is so strong that three out of five Digital Natives would switch providers if their current one didn’t offer digital experiences.

First-time buyers especially appreciate:

- Being able to compare policies at their own pace

- No pressure from salespeople

- The ability to manage everything from their phones

- Personalised coverage based on their specific needs

As more insurance companies embrace digital solutions, these benefits will become the standard that customers expect.

Benefits of Digital Insurance for First-Time Buyers

Benefits of Digital Insurance for First-Time Buyers

Digital insurance offers significant advantages for individuals purchasing insurance for the first time. Let’s examine why it might be ideal for you.

Faster policy issuance and claims

Gone are the days of waiting weeks for your insurance to start. Digital insurance companies now issue policies almost instantly through online channels. By 2030, the entire policy process will be mainly or entirely digital, with paper forms available only upon request.

What happens when you need to make a claim? Digital claims processing turns what once took days or weeks into hours or minutes. Some companies have cut claim processing times by up to 80%, while customers using mobile apps to report claims report higher satisfaction scores. This speed matters most when you’re dealing with stressful situations like car accidents or home damage.

Lower costs through automation

Your wallet will thank you for choosing digital insurance. Automation reduces expenses in several ways:

- Cuts operational costs by up to 30%

- Provides a return on investment of up to 300% within a year

- Lowers administrative costs by 30-50% through fewer manual tasks

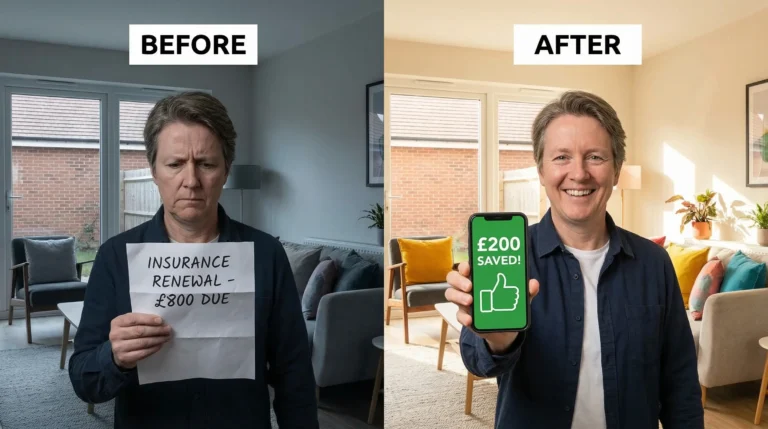

These savings often translate to lower premiums for you. Moreover, some digital insurers offer pay-per-mile options that have saved drivers an average of 47% compared to traditional insurance.

Personalised coverage options

Digital insurance doesn’t believe in one-size-fits-all policies. Through advanced data analysis, insurers can offer coverage tailored specifically to your needs.

For example, some health insurers use AI to analyse your medical history and lifestyle to recommend plans that include exactly the services you need. Similarly, auto insurance providers can track driving behaviour and offer lower rates for safe drivers.

24/7 access through digital platforms

Perhaps the most visible benefit is round-the-clock access. Digital insurance platforms let you:

- Submit claims anytime without waiting on hold

- Update policy information instantly

- Download policy documents whenever needed

- Access real-time updates on claim status

Consequently, 78% of top life insurers now offer self-service portals, while chatbots handle basic questions and only recommend calling human experts in exceptional cases.

Key Technologies Powering Digital Insurance

“With the help of data analytics, AI, and machine learning, insurers can analyze information like driving habits, health data, and previous claims. This allows them to create insurance policies that match individual needs more closely.” — Softteco, Digital transformation and software development consulting firm

## Key Technologies Powering Digital Insurance

Technology has completely changed how insurance works. Let’s look at the tools making digital insurance better for first-time buyers.

Artificial Intelligence in underwriting and claims

AI makes insurance faster and smarter. ClaimsGenAI, a tool built on 20+ years of claims data, helps process claims in minutes instead of weeks. Currently, AI tools spot fraud patterns that humans might miss, saving insurance companies millions of dollars. These systems also identify recovery opportunities beyond what human handlers discover.

Big Data and predictive analytics

Insurance companies use big data to better understand risks. About 83% of insurance executives believe predictive models are vital for future underwriting. This technology helps insurers sort customers into risk categories and set fair prices. The predictive analytics market is growing at 24% yearly.

Internet of Things (IoT) for real-time data

IoT devices like car sensors and smart home systems provide up-to-the-minute information. These devices track everything from driving behaviour to water leaks, helping both you and the insurance company. By 2025, we’ll have over 50 billion connected devices worldwide.

SaaS platforms and low-code tools

These platforms let insurance companies create new products without complex coding. Notably, about 95% of companies used low-code tools last year. These systems cut development time from months to days.

Digital insurance solutions for mobile users

Mobile apps have changed insurance. Indeed, 61% of insurance executives say changing consumer preferences pushed them toward mobile solutions. These apps let you file claims, update coverage, and get instant quotes anytime, anywhere.

Challenges and What to Watch Out For

Despite the benefits, digital insurance comes with a few hurdles. Let’s look at what to watch for when buying online.

Understanding policy terms online

Reading insurance policies online can feel like solving a puzzle. About 27% of Americans, 28% of Britons, and 32% of Australians struggle with unclear coverage details. Insurance documents often use confusing industry terms and legal language. Terms like “deductible,” “premium,” and “coverage limit” might not make sense right away if you’re new to insurance.

Data privacy and cybersecurity risks

When you buy digital insurance, you share lots of personal info online. Insurance companies hold sensitive data like health records and payment details. This makes them big targets for hackers. In fact, 75% of insurance companies saw more fraud attempts last year than before. The financial sector faces the most cyber attacks after healthcare.

Lack of human support on some platforms

Although digital tools are helpful, sometimes you need to talk to a real person. For complex situations or tough questions, human help matters. In a survey, 88% of adults said they prefer human assistance with insurance. About 61% of customers use technology, but still need to speak with someone during the process.

How to verify a digital insurance company

Before buying, check if a digital insurer is real:

- Look for proper licenses and registrations

- Read customer reviews and ratings

- Check how they handle data security

- See if they offer ways to contact real people

Always remember that 93 million Americans and British people abandoned signing up for online accounts last year because the process seemed untrustworthy or too difficult.

Conclusion

Digital insurance makes buying and using insurance much easier than the old paper-based way. We can see why it’s becoming the top choice for people buying insurance for the first time. The speed, lower costs, and ability to handle everything from your phone or computer are big pluses.

Actually, you can shop around at midnight if you want to. You can file claims right after an accident happens. You can even get insurance that’s made just for your needs.

We still need to be careful. Reading policy terms carefully, checking if a company is real, and making sure your data stays safe are all important steps.

The future of insurance is clearly digital. As technology gets even better, we expect it to become even more user-friendly and helpful. First-time buyers who take the time to understand that they will be options will likely find better coverage at lower prices than ever before.

Therefore, if you’re buying insurance for the first time, digital options are worth exploring. They save time, often cost less, and fit into our already digital lives. Just remember to ask questions when needed and pick a trustworthy company. With these simple steps, you’ll be on your way to getting the protection you need without all the hassle of traditional insurance.

FAQs

What are the main advantages of digital insurance for first-time buyers?

Digital insurance offers faster policy issuance and claims processing, lower costs through automation, personalised coverage options, and 24/7 access through digital platforms. These benefits make it particularly appealing for those new to insurance.

How does digital insurance differ from traditional insurance?

Digital insurance uses online channels and advanced technologies for all processes, from purchasing to claims. It offers a simplified, faster, and more accessible experience compared to traditional insurance, which often involves paperwork, in-person meetings, and phone calls.

Is digital insurance secure?

While digital insurance platforms implement strong security measures, there are inherent cybersecurity risks. It’s crucial to choose reputable providers, understand their data protection policies, and take personal precautions to safeguard your information.

Can I get human support with digital insurance?

Most digital insurance platforms offer some form of human support, though the level may vary. While many processes are automated, many customers still prefer human assistance for complex situations or specific questions.

How can I verify the legitimacy of a digital insurance company?

To verify a digital insurer’s legitimacy, check for proper licenses and registrations, read customer reviews and ratings, examine their data security practices, and ensure they offer ways to contact real people. It’s important to do thorough research before purchasing a policy.