Introduction

Insurance is a must financial tool to protect individuals, a business and assets from the unexpected risks. Flow Insurance has recently become an increasingly popular type of insurance, which has also become a trend, that offers a flexible and yet innovative types of insurance for different requirements. But what is Flow Insurance and what makes them stand out from other insurance providers?

On this article we will cover the coverage options, benefits and other peculiar features of Flow Insurance. This guide is intended to help anyone that is new to insurance buying as well as anyone that needs to change insurance providers.

What is Flow Insurance?

Flow Insurance stands out as a modern insurance company, that offers flexible coverage options, has a user friendly technology and centered around customer first approach. Unlike a typical insurer that has rigid policies, Flow Insurance offers a custom setup of coverage specifically to a person’s or company’s unique risks. Aided by the most up to date digital tools coupled with a clear cut claims process, the company will ensure a seamless journey for its policyholders.

Coverage Options

Flow Insurance provides a wide variety of coverage options for many different sectors and risk profile. There are several types of insurance policy available as follows:

Auto Insurance

Auto coverage from Flow Insurance is designed primarily for different type of auto owners. Their auto insurance options include:

Liability Coverage: Prevents the customer from being liable for damages that he caused to others in an accident.

This covers any repairs of the vehicle after an accident, whether the vehicle was at fault or not.

Comprehensive Coverage: Protects against non-collision incidents such as theft, vandalism, or natural disasters.

Pay Per Use models should be great for low mileage drivers who would feel Usage Based Insurance will work for them.

Homeowners Insurance

There is Flow Insurance with home insurance policies, and they include is:

Basic Coverage: Protects against fire, theft, and certain natural disasters.

Extended Replacement Cost: Provides coverage limits to guarantee a full reconstruction of a home in the unfortunate case of the damages exceeding the coverage limit.

Coverage for personal liability if someone is hurt on the property.

Add-ons for Smart Homes: Special coverage for IoT-connected devices and smart security systems.

Renters Insurance

For tenants, Flow Insurance provides:

Personal Property Protection: Lefts you covered for theft, fire, an accident, etc., regarding your personal belongings.

Liability coverage: An insurance policy that covers injuries sustained by someone on rented space.

Temporary Housing Assistance: Pays for accommodation in case of property damage.

Business Insurance

- Small business and large enterprises can turn to Flow Insurance for policies that will meet their needs.

- General Liability Insurance will protect from lawsuits related to injuries or property damage to third parties.

- Professional Liability Insurance: Ideal for consultants and freelancers against negligence claims.

- Cybersecurity Insurance: Protects businesses against data breaches and cyber threats.

- Workers’ Compensation: Covers employee medical expenses and lost wages due to workplace injuries.

Life Insurance

Life insurance options include:

- Term Life Insurance: Provides coverage for a specified period.

- Whole Life Insurance: Offers lifelong protection with a savings component.

- Universal Life Insurance: A flexible policy with investment options.

Health Insurance

Flow Insurance also provides flexible health coverage as:

- Individual and Family Health Plans

- Supplementary Health Insurance

- Critical Illness Coverage

Key Benefits of Flow Insurance

However, Custom Insurance has several unique advantages for distinction, namely:

Flexible and Customizable Policies

Traditional insurers, on the other hand, compel a customer to prepay for a whole year, whether she wants it or not. Policyholders have more control in making decisions such as adding specific coverage additions or adjust deductibles.

Simplified Claims Process

The claims process is also streamlined by Flow Insurance with the use of digital tools; paperwork is reduced and waiting time is considerably reduced. Processes can be done within days versus weeks on many claims.

Usage-Based Pricing

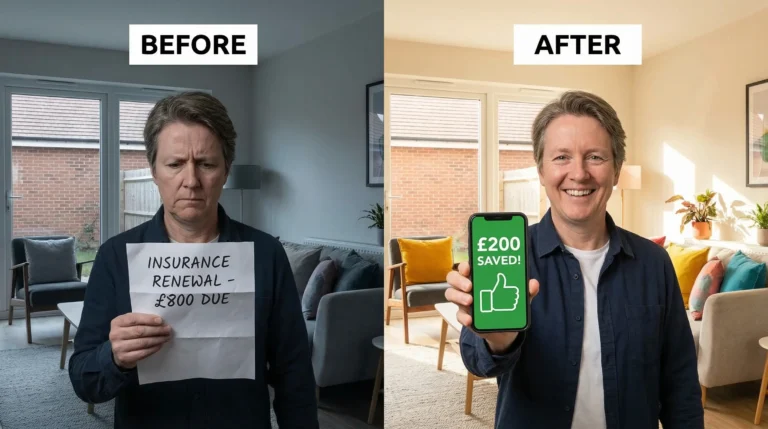

Flow Insurance specializes in providing pay as you go type insurance models for auto and health, where the premiums are set according to the actual usage, hence liable to make a cost reduction for careful drivers and healthy people.

Strong Customer Support

Flow Insurance is equipped with AI driven chatbots and a human representative, offering 24/7 helpdesk ensuring quick resolutions for the policy holders.

Digital-First Experience

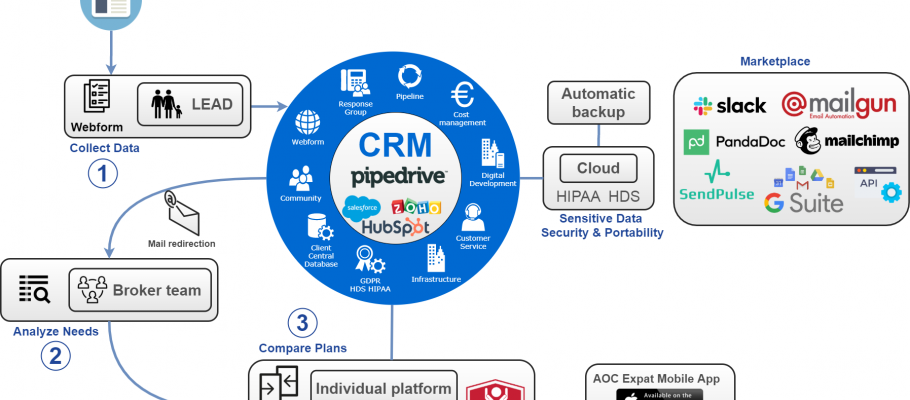

Flow Insurance also serves policy management, claim submissions and premiums through mobile apps and online platforms.

Insurance Helped a Small Business Recover

One is the case where John, a small business owner, is a victim of a cyberattack, resulting in his customer data getting compromised. He was fortunate to have cybersecurity insurance through Flow Insurance. Flow Insurance also covered the recovery costs, legal fees, and compensation for the affected customers within 48 hours, thus helping John regain the trust of his customers and keep business as usual.

Identify the Right Flow Insurance Policy

Assess Your Needs

Before you go ahead and purchase insurance, decide on how much risk you are willing to take when it comes to your finances. Property value, debt liabilities and future medical bills are all things to consider.

Compare Policy Options

Your options for different coverage should be reviewed and make sure it meets your requirement. Don’t go for unnecessary add on’s that are going to add up to the premiums.

Read Customer Reviews

So you want to have a look at testimonials and independent reviews as it gives you an idea about how customers are satisfied and makes a claim settlement much more quicker.

Consult an Expert

If you are not sure just seek advice by insurance advisor. If unsure, seek advice from an insurance advisor to understand policy details and benefits.

Conclusion

With its customer-centric policies, flow Insurance, brought the insurance industry into the digital era and to rethink the usage of insurance back in 2012. Flow Insurance provides complete coverage for auto, home, business, and life insurance.

Here, you’ll know about the coverage options and its benefits as mentioned in this article so that you can take the best possible decision and can go for a policy that will offer the best value for your money. Flow Insurance is a great choice to consider if you are pondering changing your insurance provider or acquiring new policy.