Building Insurance As a Concept

This is where the building insurance comes in handy as it answers the important questions; what does it cover?

This insurance policy covers external and internal structural areas of the property such as; walls, roof, floor, fitted kitchen, built-in wardrobes among others. It often includes events that threaten your home like fire, floods, storm, and vandalism, keeping your homes structure safe.

The main reasons why homeowners should embrace building insurance.

From the owners’ perspective, building insurance plays the vital role because one of the most valuable and rather large investments – the house – is insured here. Without it, every structural damage means additional spending on repair that I might not afford without assistance, to begin with. In the same breath, most mortgage lenders insist on building insurance as a standard prerequisite for loan approval which has made it necessary for many building owners.

Exploring Home Insurance

The second question is what does home insurance consist of?

Home Insurance also commonly known as content insurance takes care of property that is within the property owner’s home. It can be items such as furniture, electronics, clothing, down to what is considered valuable, such as jewelry or artwork. It’s generally used against hazards such as theft, including water damage, fire outbreak, and loss, thus giving a client confidence that his/her property is secure.

Advantages of Home Insurance

People who have home Insurance are capable of replacing of repairing household items without struggling financially sake. It can also cover property within and if not, it covers belongings the policyholder is away from the home, say while on an errand. Also some policies cover you in case you are sued for an injury that happens within the Residence or in case your residency harms the property of others.

Key Differences Between Building and Home Insurance

Coverage Comparison

The main variation is in what each kind of insurance defends. Business structure Insurance is whereby the owner of a structure insures the building and permanent structure such as; light fixtures. In addition to the above mentioned policy, the following give you complete insurance for your property and belongings.

Cost Differences

Contemplating that structure repair and construction costs a lot the building insurance are relative costly. It is cheaper than home insurance as it insures movable property which are comparatively of less value than real properties. However, the premium for both depends with factors such as; geographical location ,risk factor and the type of policy desired.

What Insurance Is Required: Building and Home?

Conditions Which Requires Both Favourable Conditions For Both

If you own your home and have valuable items in the house, having building and home insurance is important. Suchende coverage makes sure that there is an all-round coverage against risk that may happen to the building or things in it.

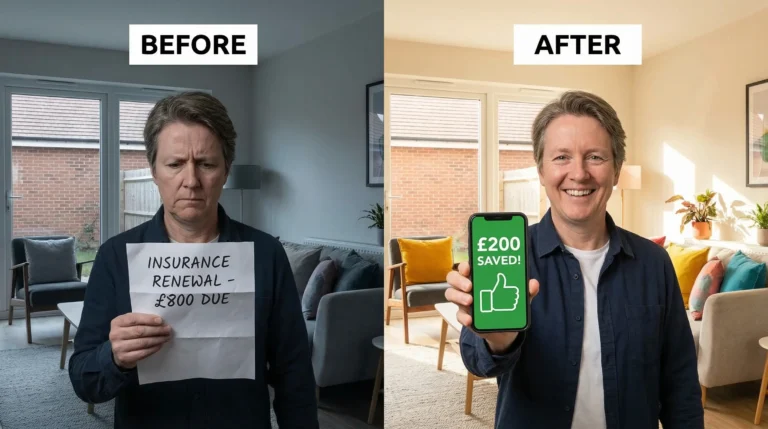

Effective yet inexpensive advertising for overall insurance protection

If you want a plan that is comprehensive enough but will cost less keep an eye on your building and home insurance where you can get them from one insurance company. This means that reviewing such policies at least once per year, raising your deductible, and incorporating things such as alarm systems would make your car insurance cheaper while still being just as good, if not better.

Guideline in Selecting the Best Insurance Policy on Your Property

Assessing Your Risks

In this case, there is always a need to evaluate your needs when choosing an insurance policy. To this end, people should take into account the worth, quality and overall value of the home, ability to restore or reconstruct and total assigned value of items and accessories. Further, assess possible hazards in your state such as hazards as floods or crime rate in your area to besafe that the policy put in place covers all these aspects. An understanding of the various risks will help you decide on the appropriate limits that are satisfactory to your insurance needs while avoiding the unrelated frills.

National Policy vs. Policy Comparison for Best Value

Different insurance policies exist, and that means that one has to compare the policies offered by different insurance companies. Go deeper than premium rates and consider the range of entities as well as the enterprises, advantages, and disadvantages that each policy provides.

Make sure to read the small print because these will determine your rights the next time you need to make a claim. However, it is recommended that one compares the market and get some quotes in order to achieve this balance of a good rate and good cover.

A Quick Overview of Some of the Most Popular Myths of Building and Home Insurance

Debunking Misconceptions

A couple of misunderstandings relating to homeownership include that a home insurance policy covers structural issues, which is false unless mentioned in the policy. Another myth is that only homeowners require insurance, but renters also can take advantage of contents coverage for their property.

Also, many people think that insurance will cover any kind of loss, but most do not cover various losses; for instance, wear and tear are excluded, or even war, which has to be included separately or needs a rider.

Understanding Policy Terms

It is important always to closely understand the meaning of the terminologies contained in your policy. Such terms as ‘replacement cost,’ actual cash value,’ and ‘deductible’ has a bearing on claim handling. For instance, replacement cost covers the costs of replacing or reconstructing items without taking into account the value degradation’s while actual cash value includes such a degradation.

It is important to make sure your insurer understands where you’re coming from, particularly on these terms, because you never know what they are going to hit you with when it’s time to process the claim.

Conclusion: Making the Right Insurance Decision

Selecting the proper building as well as home insurance is the essential first steps towards adequate protection against possible losses. To that end, identifying your needs, comparing policies for their value and eradicating myth surrounding such policies will help one choose the most suitable policy for your property and your life.

Any extra time, which one spends studying opportunities, helps significantly to be ready for anything that might happen in the future and protect the future and things which are important in one’s life.

FAQs

1. What can be expected when paying building insurance?

Householders’ insurance usually extends to the fabric of your house, this means walls, roof, floors, fixed sanitary installations such as built-in cupboards and bath rooms. It may also encompass protection against hazards more such as; fire, flooding, and storm disaster among others.

2. Some people often use the terms interchangeably and you will ask, is home insurance and building insurance the same thing?

No, they are different. There is home contents insurance commonly called home contents insurance, which keeps your personal property within your home safe, and there is also building insurance which covers the structure of your home.

3. Do I need building insurance if I’m the landlord?

Usually, tenants do not pay for building insurance, it is the landlord’s duty. However, you may require renters insurance especially for your household effects.

4. How do I decide this degree of exposure?

Impact should estimate the cost of rebuilding your home right from scratch if it were destroyed to the barest level, not just the value of the property. This amount can be estimated with the help of the professional surveyor.

5. Are natural disasters included in all the policies?

It all depends on the policy in question. In some cases, such as earthquake or flood, other coverage may be necessary. You must read the fine print and of course talk to the insurance provider so that you can gauge your level of coverage.