What is Generally Excluded from Building Insurance?

Today we discuss Is home insurance mandatory Contents insurance often referred to as ‘contents’ relates to items within the building and covers fixed installations including the walls, roof, floors, permanent fixtures and fittings for instance the kitchen and the bathroom. It makes them shield their property against dangers such as fire, flood, storm, and at times, such events as damage.

It also worth noticing that some policies may also offer an option to cover items such as garages, sheds, fences as well as other outbuildings on the premises. Thus, the simplest way is to refer to the full details of the policy to read or clarify the provisions of the insurance policy.

Who Needs Building Insurance?

Having a property owner should think of getting a building insurance more so if the owner has a home loan because lenders expect it. Tenants let out property also get to vie for this insurance to enable them protect their investment against any damages that may occur in future. This is because even when one owns a house cash, building insurance offers the assurance of protecting ones property against structures losses and damage.

Exploring Home Insurance

Main Index of Home Insurance

Home insurance is meant to cover your property and in some instances loss of use expenses if your home becomes a living area due to an insured calamity. Its components usually involve protection from theft, damage by any other member of the family, loss of items that are not fixed in the house and other outside factors. A number of these policies also allow the policyholder to choose added benefits like coverage for items across the globe, or endorsements for expensive items.

Why do You Need Home Insurance?

The major reason why one should have home insurance is to cover his property against any incidents. Regardless of if it is a break in, a fire, or flood, home insurance can shield you from the cost of repairing or replacing items. Also, it enhances security and people’s confidence, so you can live in your home without having to think about the danger in every corner.

If you’re new to the insurance industry, you may wonder what distinguishes between building and home insurance.

Coverage Comparison

While the building insurance and home insurance are related, the two are distinct from one another and can work in tandem with one another for your own protection. Home warranty principally concerns itself with the physical exterior of your home like walls, roofs, floors, and any other structure or content that can be fixed to the property including fitted kitchens or bathrooms.

It guards against losses from hazards such as fire, storms, floods, and occasionally from mishaps. Home Insurance, also known as contents insurance, covers personal property inside the property in question. This may for instance be in furniture, electrical appliances, clothes and any other thing of value. It is important to understand the difference because you need to be covered for contents and belongings both in the building and its surrounding.

Policy Costs and Premiums

The cost of building insurance is usually pegged on the rebuild value of your home, that is, the amount that it would cost you in today’s economy to rebuild your home from scratch. On the other hand, the home insurance premiums depends on the insurance coverage that you want plus the total value of your property inside your home. Typically, your location, security measures, and your company’s claims history determine the total cost of cover. In this way, the insurers can realize a specific premium corresponding to the risks, having evaluated these parameters.

All You Need to Know About Selecting the Right Insurance Policy

Considerations to Make When Buying

To most, it is very important to consider some choices before opting for an insurance policy they need to benefit from. It would be helpful if you think of the kind of house you have, where you live and your possessions. Check that the policy does provide sufficient for the primary and excess limits and any extra ones such as accidental damage or valuable products.

Also, look through the policy and the exceptions and the deductible so that you do not have to deal with the shock of finding out that you are not covered for something you assume you are. To get the best out of it, you have to compare several insurers to be in a better position to tell which plan is right for me and at what cost.

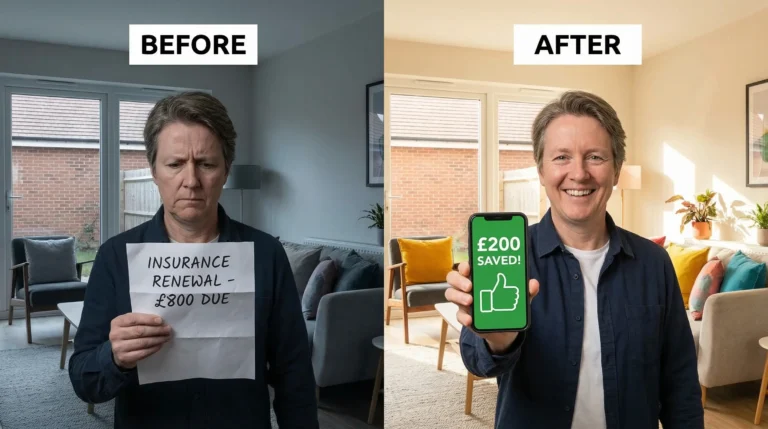

Insurance expenses are definitely an area where most people can stand to make some savings, for those willing to cut back on some of the higher costs, these are the ways to do it.

As a result, here are some of the measures that you can undertake so that to reduce the insurance cost. Ensuring that one has put in place safety features that include alarm systems, smoke detectors, and strong locks can see one has his or her premiums reduced. For example, getting both building and home insurance is cheaper when bought from the same insurance service provider.

Also, it is possible to decrease your monthly premiums by choosing a higher amount on a deductible; however, you should be prepared to pay this amount if necessary. Lastly, the analysis of your coverage frequently allows to avoid both overinsurance and underinsurance and to pay for what is necessary.

Conclusion

Is home insurance mandatory Having an insurance for building and homes is very crucial in cases of disasters as it’ll safeguard all your property. Collecting information on available coverage options, potential differences between two policies and possible ways of saving money will make your choice much easier. It may take some time to undergo the needs analysis and compare many insurance companies, but then one can obtain the policy that would meet the required level of protection for an affordable price.

Note, that any further changes to mrb coverage should on regular basis reflect changes in your life or circumstances. Mention that with the correct insurance therefore, you are assured of your belongings and your house will be safe in case of any harm.

FAQs

1. What class of risks does one get when taking a home insurance?

Especially, home insurance can pay for the losses that are occurred to your house and your property due to fire, theft, vandalism and storm and other disasters. It also may contain liability coverage that works to shield you in the event of an occurrence like this naturally you will be held as liable for any medical bills the individual incurs on your property If the person decides to take you to court then you are in trouble.

2. Is flood cover provided in normal home insurance policy?

Actually, most of the available home insurance policies exclude flood damages. People staying in the higher risk flood zone areas may require buying an individual flood insurance policy as the normal home insurance may not cover floods.

3. How can I register for self employed social security?

There are many things that you can do to help lower your premiums. Available discounts There are perks to bundling your home insurance, and which include auto insurance. Other things, which help minimize insurance costs include raising your deductible, upgrading security systems in your home and comparing insurance quotes from insurers frequently.

4. What should you know about actual cash value and replacement cost of a property?

Actual cash value pays up to the odds you lost or had damaged items’ depreciated value back to you while replacement cost pays the amount required to replace the damaged items with new ones without considering their current value.

5. When should I review my home insurance policy?

The best time to start reviewing your policy is once a year or even when you realize some changes, perhaps in your house or you have bought new items that are expensive or any changes that may lead to change of your living standards. This type of evaluation also guarantees that your coverage is adequate for meeting today’s, as opposed to yesterday’s, requirements.