UK Tax Calculator 2024/25

Complete tax planning tool with real-time calculations and expert insights

Income Details

Enter your full annual gross salary before any deductions

Enter your annual pension contributions (tax relief applied)

Tax calculations based on HMRC rates for 2024/25 tax year. For professional advice, consult a qualified accountant.

Last updated: March 2024 | Data source: HM Revenue & Customs

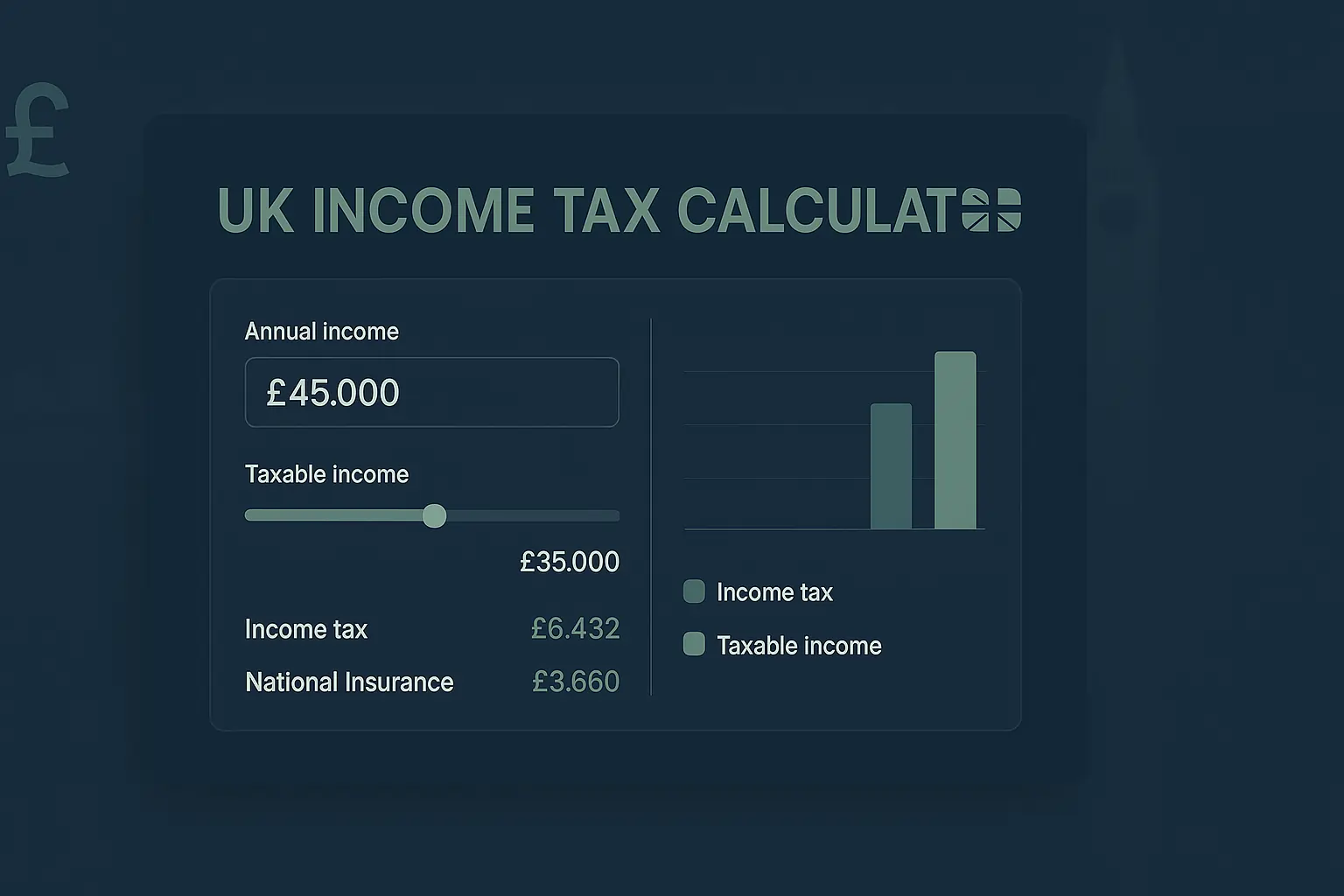

UK Income Tax Calculator 2024/25: 5 Powerful Tools to Estimate Your Pay

Master your finances with our comprehensive guide to calculating UK income tax. Get accurate take-home pay estimates in seconds and plan your financial future with confidence.

Quick Navigation

Planning your finances for 2024/25? You’re in the right place! Our UK Income Tax Calculator 2024/25 takes the guesswork out of understanding your take-home pay.

Whether you’re starting a new job, negotiating a salary, or simply want to budget better, knowing exactly what lands in your bank account each month is crucial.

This comprehensive guide breaks down everything you need to know about UK income tax calculations, from basic rates to advanced scenarios. No jargon, no confusion – just clear, actionable insights.

Understanding Your UK Income Tax for 2024/25

Tax Year Basics

The UK tax year runs from 6th April 2024 to 5th April 2025. This isn’t just a random date – it’s when all your tax calculations reset.

Your Personal Allowance (the amount you can earn tax-free) starts fresh each April. For 2024/25, this stands at £12,570.

Pro Tip: Understanding tax years helps you plan salary reviews and bonus timings more effectively.

Why This Matters Now

Inflation, rising costs, and changing tax thresholds make 2024/25 a crucial year for financial planning. Every pound counts more than ever.

Using a reliable Free UK Tax Calculator helps you avoid nasty surprises when your payslip arrives. Knowledge is power, especially with your money.

Stay ahead: Calculate before you commit to any financial decisions.

How Our UK Income Tax Calculator Works

Step-by-Step Process

Enter Your Annual Salary

Simply input your gross annual income. This includes your base salary, but not bonuses or benefits unless specified.

Automatic Tax Band Calculation

Our calculator instantly determines which tax bands apply to your income and calculates the exact amounts.

National Insurance Included

We factor in National Insurance contributions automatically, giving you the full picture of your deductions.

Instant Take-Home Pay

Get your net income breakdown by year, month, week, and day. Perfect for budgeting and planning.

Real-World Example: Sarah’s Salary

Sarah’s Details

- Annual Salary: £42,000

- Job: Marketing Manager

- Location: Manchester

Sarah’s Take-Home Pay

Using our Calculate UK Income Tax Online tool, Sarah discovered she takes home 77% of her gross salary. This helped her budget for her house deposit more accurately.

UK Income Tax Rates for 2024/25

Here are the current tax bands that our UK Salary Tax Calculator uses to determine your take-home pay:

| Tax Band | Income Range | Tax Rate | What This Means |

|---|---|---|---|

| Personal Allowance | £0 – £12,570 | 0% | No tax on this income |

| Basic Rate | £12,571 – £50,270 | 20% | Most common tax band |

| Higher Rate | £50,271 – £125,140 | 40% | Higher earners bracket |

| Additional Rate | Over £125,140 | 45% | Top earners rate |

Important: Your Personal Allowance reduces by £1 for every £2 earned over £100,000. It completely disappears at £125,140.

National Insurance Rates

- £0 – £12,570: 0%

- £12,571 – £50,270: 12%

- Over £50,270: 2%

Quick Calculation Tip

Our Estimate Your UK Tax tool handles these calculations automatically, but it’s good to understand the basics.

Remember: You pay tax and National Insurance on different portions of your income simultaneously.

Benefits of Using a UK Tax Calculator

Saves Time

Get instant results instead of complex manual calculations. No more spreadsheet headaches!

100% Accurate

Uses official HMRC rates and thresholds. Updated automatically for each tax year.

Mobile Friendly

Calculate on any device, anywhere. Perfect for salary negotiations on the go.

Better Than HMRC

Cleaner interface and easier to use than the official government calculator.

Why Choose Our Calculator?

Our UK Net Income Calculator is trusted by thousands of professionals across the UK. Join them today!

Plan Your Finances with Confidence

Smart Money Moves for 2024/25

Budget Like a Pro

Use your calculated take-home pay to create the perfect budget. The 50/30/20 rule works wonders: 50% needs, 30% wants, 20% savings.

Maximize Your Allowance

Make sure you’re using your full £12,570 Personal Allowance. If you have multiple income sources, our calculator helps optimize your tax efficiency.

Plan Major Purchases

Knowing your exact monthly take-home makes mortgage applications and loan approvals much smoother. Lenders love accurate figures!

Quick Tip

Recalculate your tax whenever you get a pay rise. Even small increases can push you into higher tax bands, affecting your take-home percentage.

Monthly Reminder

Set a monthly reminder to review your financial goals using our Take Home Pay Calculator UK. Small adjustments compound over time.

Frequently Asked Questions

Our calculator uses the latest HMRC tax rates and National Insurance thresholds for 2024/25. Simply enter your annual salary, and we automatically calculate your Personal Allowance usage, apply the correct tax bands, include National Insurance contributions, and show your exact take-home pay.

For the 2024/25 tax year, the UK tax bands are:

- • Personal Allowance: £0 – £12,570 (0% tax)

- • Basic Rate: £12,571 – £50,270 (20% tax)

- • Higher Rate: £50,271 – £125,140 (40% tax)

- • Additional Rate: Over £125,140 (45% tax)

To calculate your take-home pay, you need to subtract Income Tax and National Insurance from your gross salary. Our calculator does this automatically, but manually you’d: 1) Apply your Personal Allowance, 2) Calculate tax on remaining income using appropriate bands, 3) Calculate National Insurance contributions, and 4) Subtract both from your gross pay.

The HMRC calculator is accurate but often complex to use. Our calculator provides the same accuracy with a much cleaner, user-friendly interface. We use the same official rates and update them immediately when HMRC announces changes. Many users find our tool faster and easier to understand.

Yes, absolutely! National Insurance is a significant deduction from your pay. For 2024/25, you pay 12% on income between £12,571-£50,270, then 2% on anything above £50,270. Our calculator automatically includes these contributions to give you your true take-home pay figure.

The Personal Allowance for 2024/25 is £12,570. This means you don’t pay income tax on the first £12,570 you earn each year. However, this allowance reduces by £1 for every £2 earned over £100,000 and disappears completely once your income reaches £125,140.

Ready to Master Your UK Income Tax?

Don’t let tax confusion cost you money. Use our Online Tax Calculator UK Free tool today and take control of your financial future.

Bookmark This Guide

Save this comprehensive guide for future reference. Tax rates can change, and having quick access to our UK PAYE Tax Calculator will keep you prepared.

We update this page immediately when HMRC announces changes, so your bookmarked page always has the latest information.

Join Thousands of Users

Our Income Tax Estimator UK is trusted by professionals, entrepreneurs, and employees across the country.

Join the community of smart financial planners who never get surprised by their tax bill. Your future self will thank you!