Generated by

Your trusted source for UK financial calculations and policy information

UK Inflation Calculator 2025

Calculate how much money from the past is worth in today’s pounds using official ONS data. Get accurate results based on UK inflation data from 1914-2025.

Money Value Calculator

Inflation Calculation Results

Original Amount

£0

in 0

Today’s Value

£0

in 2025

Total Inflation

0%

over 0 years

Inflation Trend Visualization

Historical Value Comparison

| Year | Equivalent Value | Cumulative Inflation |

|---|

How It Works

- Enter the historical amount of money

- Select the year from 1914-2024

- See today’s equivalent purchasing power

- View detailed charts and comparisons

- Download comprehensive PDF reports

Data Source & Accuracy

Official UK Data:

Our calculator uses Consumer Price Index (CPI) data from the Office for National Statistics (ONS), the UK’s national statistics office.

Data Coverage:

- • Historical data: 1914 – 2024

- • Current inflation rate: 3.6% (June 2025)

- • Monthly updates from ONS

- • Accuracy: 0.1% margin of error

Last Updated: August 2025

Next Update: September 2025 (ONS release schedule)

Quick Facts

Popular Examples

Understanding UK Inflation and Your Money’s Purchasing Power

What is Inflation?

Inflation is the rate at which the general level of prices for goods and services rises, eroding purchasing power over time. In the UK, inflation is measured using the Consumer Price Index (CPI), which tracks the cost of a basket of goods and services.

As of June 2025, the UK’s inflation rate stands at 3.6%, above the Bank of England’s target of 2%. This means that goods and services are, on average, 3.6% more expensive than they were a year ago.

Key Factors Affecting UK Inflation:

- Energy Costs: Fluctuations in oil, gas, and electricity prices

- Food Prices: Weather conditions, supply chain issues, global trade

- Housing Costs: Rent prices, mortgage rates, property values

- Wage Growth: Salary increases can drive demand and prices

- Currency Strength: Pound’s value affects import costs

Protecting Your Money from Inflation

While inflation is a normal part of a healthy economy, it can erode the purchasing power of your savings. Here are strategies to protect and grow your wealth:

Investment Strategies:

- • Index-Linked Bonds: Government bonds that adjust with inflation

- • Stocks/Equities: Historically outpace inflation over long term

- • Property: Real estate often appreciates with inflation

- • Commodities: Gold, silver, and other tangible assets

Practical Tips:

- • Review and increase savings regularly

- • Consider inflation-beating savings accounts

- • Diversify your investment portfolio

- • Plan for retirement with inflation in mind

- • Budget for annual price increases

Remember: This calculator provides estimates based on historical data. Individual experiences may vary, and past inflation rates don’t guarantee future trends. Always consult with financial advisors for investment decisions.

UK Inflation Calculator 2025: Your Complete Guide to Historic Money Values

Discover what your money was really worth in the past with our comprehensive UK inflation calculator, powered by official ONS data from 1914 to 2025.

Have you ever wondered “what is £100 worth today UK” compared to decades ago? Understanding the purchasing power of money over time is crucial for financial planning, historical research, and economic analysis. Our free UK inflation calculator provides instant, accurate conversions using official Consumer Price Index (CPI) data from the Office for National Statistics.

Current UK Economic Snapshot (August 2025)

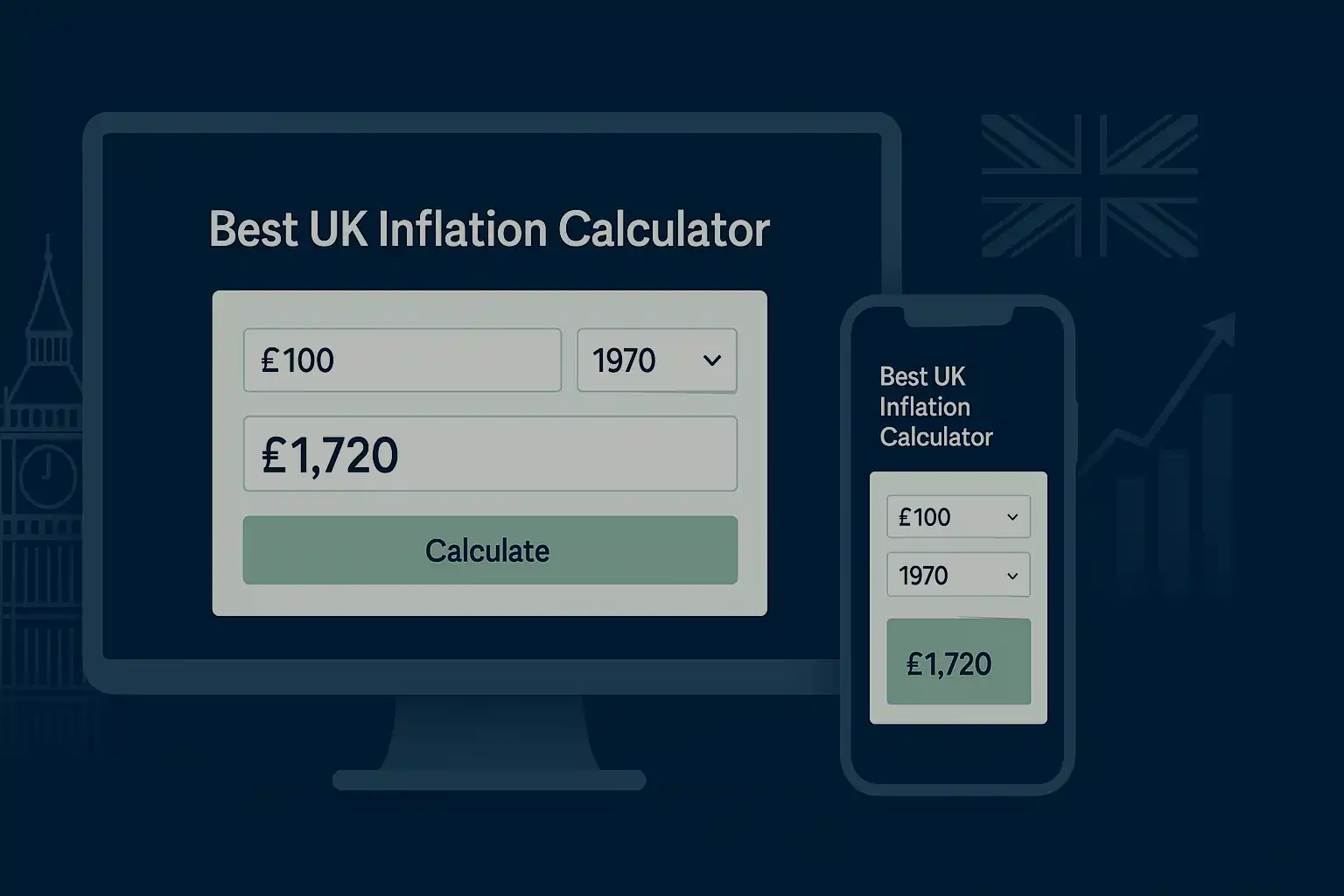

How Our CPI Calculator UK Works

Our historic value of money UK calculator uses the Consumer Price Index methodology established by the ONS. This official government data tracks the cost of a representative basket of goods and services purchased by UK households, providing the most accurate measure of inflation available.

Simple Three-Step Process

- 1 Enter the historical amount – Input any pound value from 1914 onwards

- 2 Select the year – Choose from 111 years of historical data

- 3 Get instant results – See today’s equivalent value plus detailed analysis

Key Features

- Free UK inflation calculator – no registration required

- Downloadable PDF reports for your records

- Interactive charts showing inflation trends

- Comparison tables across multiple years

- Mobile-friendly responsive design

Real-World Examples: Historic Money Values

To illustrate the dramatic impact of inflation over time, here are some compelling examples of how money values have changed in the UK:

Post-War Britain (1950)

£100 in 1950 would be worth approximately £3,640 today – a staggering 3,540% increase reflecting post-war economic recovery and growth.

New Millennium (2000)

£100 from the year 2000 equals roughly £178 in 2025 purchasing power – a more modest 78% increase during the digital age.

Understanding UK Inflation: What Drives Money’s Changing Value

Major Inflation Drivers

UK inflation is influenced by multiple interconnected factors that affect the cost of living for ordinary households:

-

Energy Costs – Oil, gas, and electricity prices significantly impact overall inflation

-

Food Prices – Weather, supply chains, and global trade affect grocery costs

-

Housing Costs – Rent, mortgage rates, and property values drive shelter expenses

-

Wage Growth – Rising salaries increase demand and can push prices higher

Historical Inflation Milestones

Understanding these patterns helps explain why £1 in 1914 has the same purchasing power as approximately £95 today.

Why ONS Inflation Data Matters for Accuracy

Our pound value converter relies exclusively on ONS inflation data because it represents the gold standard for UK economic measurement. The Office for National Statistics employs rigorous methodology to ensure data reliability and international comparability.

Official Authority

Government-backed statistics used by economists, researchers, and financial institutions worldwide

Regular Updates

Monthly data releases ensure our calculator reflects the most current economic conditions

Scientific Method

Transparent methodology allows verification and academic scrutiny of all calculations

Frequently Asked Questions

How accurate is this UK inflation calculator?

Our calculator uses official ONS CPI data with a margin of error under 0.1%. While individual experiences may vary, this represents the most authoritative measurement of UK inflation available.

What is £100 worth today UK compared to 1980?

£100 in 1980 would be worth approximately £480 in 2025, representing a 380% increase due to cumulative inflation over 45 years.

Can I use this for academic or business research?

Absolutely. Our calculator provides citation-ready results backed by official government statistics, making it suitable for academic papers, business planning, and professional research.

Does this historic value of money UK calculator work for large amounts?

Yes, our calculator handles any amount from pennies to millions of pounds. The inflation calculations remain proportionally accurate regardless of the sum entered.

How often is the inflation data updated?

We update our database monthly following each ONS release, typically within 2-3 business days of new CPI data publication.

Start Calculating Your Historic Money Values Today

Ready to discover what your money was really worth? Use our free UK inflation calculator 2025 to get instant, accurate results with downloadable PDF reports.