UK Policy Checker Tool 2025

Check if you’re underinsured with our advanced UK policy analysis tool

Inflation Impact

Regional Analysis

Savings Calculator

Visual Reports

UK Life Insurance Policy Checker 2025: Are You Underinsured?

Complete guide to checking your life insurance coverage in the UK – including free policy checker tool

Table of Contents

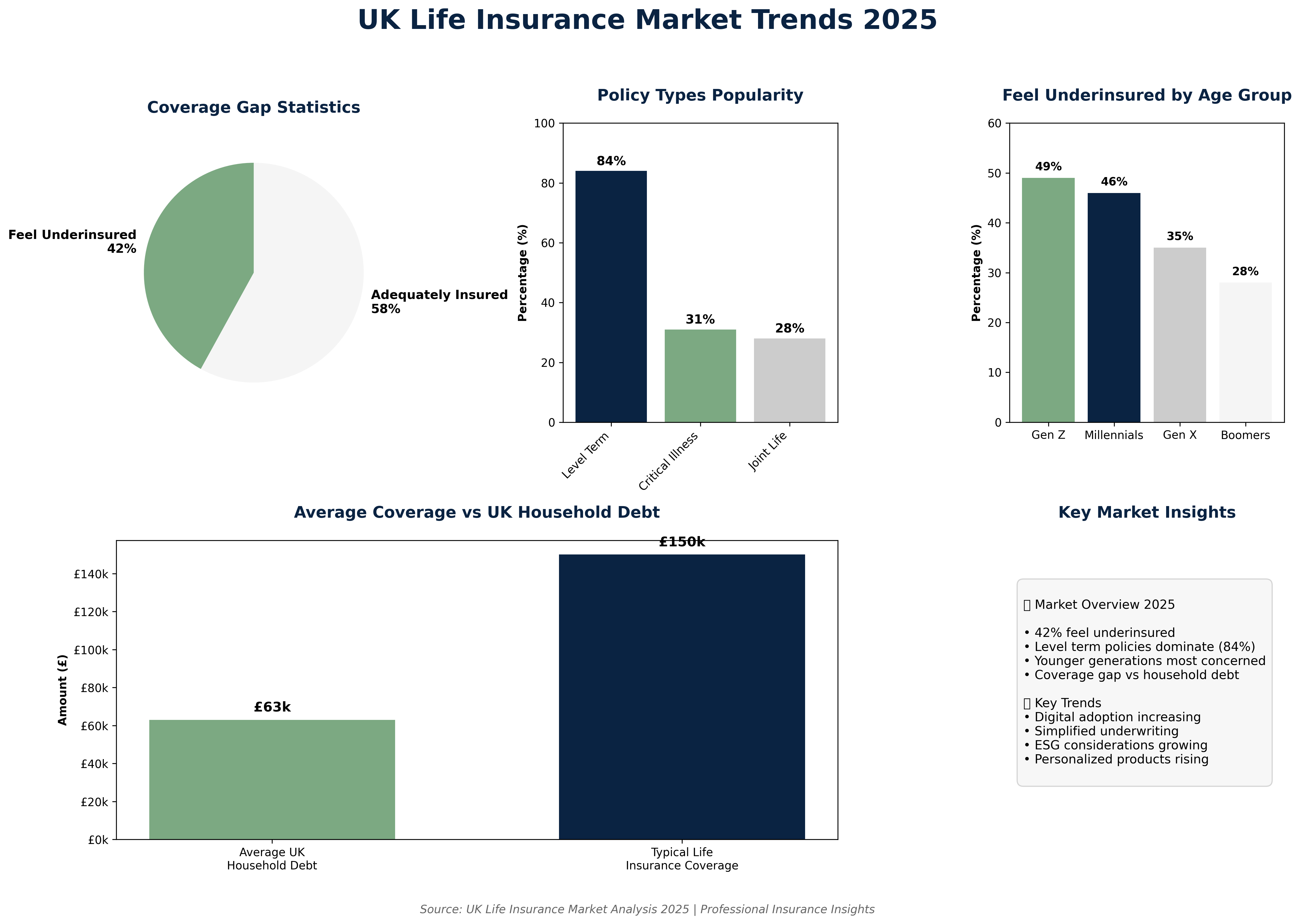

Did you know that 42% of UK adults feel underinsured when it comes to life insurance? With the cost of living crisis hitting families hard in 2025, many people are discovering their life insurance policies from years ago just don’t cut it anymore.

This guide will help you understand if your life insurance policy still protects your family properly. We’ll show you exactly how to check your coverage, what to look for, and when it’s time to make changes.

Important Alert

Recent studies show that UK households now need an average of £63,000 just to cover basic debt. If your policy is older than 5 years, you might be seriously underinsured.

Why Check Your Life Insurance Policy in 2025?

Life changes. Your financial situation today is probably very different from when you first bought your policy. Here’s what’s changed in the UK since 2020:

- House prices up 23% – Your mortgage protection might not be enough

- Cost of living increased 18% – Your family needs more money to maintain their lifestyle

- Average household debt now £63,000 – Including mortgages, credit cards, and loans

- Childcare costs up 31% – Your family’s expenses have grown significantly

We’re seeing more families realize their old policies just don’t provide enough protection anymore. The gap between what people have and what they need has grown dramatically since 2020.

Shocking UK Life Insurance Statistics for 2025

Source: UK Life Insurance Market Analysis 2025

These numbers tell a clear story. Almost half of UK adults don’t feel confident their life insurance would properly protect their family. And younger people are even more worried – nearly 50% of Gen Z adults feel underinsured.

What This Means for Your Family

If you’re in that 42% who feel underinsured, you’re not alone. But here’s the good news: most people can fix this problem without breaking the bank. Sometimes it’s as simple as updating your policy amount or finding a better deal.

5 Clear Signs You’re Underinsured

Not sure if your policy is still good enough? Here are the biggest warning signs:

1. Your Policy is Less Than Your Mortgage

If you owe £200,000 on your mortgage but only have £100,000 life insurance, your family couldn’t even pay off the house if something happened to you.

2. You’ve Had Kids Since Your Policy Started

Children are expensive. Childcare, education, and general living costs add up quickly. Your old policy might not cover these new expenses.

3. Your Income Has Gone Up Significantly

If you’re earning much more now than when you bought your policy, your family has probably gotten used to a higher standard of living.

4. Your Policy is Over 5 Years Old

Costs have gone up a lot since 2020. A policy that seemed plenty back then might not be enough now.

5. You Have More Debt Than Before

Credit cards, loans, car payments – if your debt has grown, your life insurance should probably grow too.

How to Check Your Policy (Step by Step)

Checking your life insurance policy doesn’t have to be complicated. Here’s exactly what to do:

Step 1: Find Your Policy Documents

Look for your original policy documents or log into your insurance company’s website. You need to know:

- How much coverage you have

- When your policy expires

- What type of policy it is (level term, decreasing, etc.)

- How much you pay each month

Step 2: Calculate What You Actually Need

A good rule of thumb is 5-10 times your annual income. But you should also consider:

- Your mortgage balance

- Other debts (credit cards, loans, etc.)

- How much income your family would need to maintain their lifestyle

- Future expenses like children’s education

Step 3: Use Our Free Policy Checker Tool

Our tool at the top of this page will do all the math for you. It considers inflation, regional cost differences, and current UK market standards. Just enter your details and get instant results.

Step 4: Compare Your Results

If there’s a big gap between what you have and what you need, it’s time to look at your options. You might need to:

- Increase your current policy amount

- Buy additional coverage

- Switch to a different type of policy

- Shop around for better rates

How Inflation Has Affected Your Coverage

This is where things get really interesting. Inflation has been brutal in the UK over the past few years. Here’s what £100,000 of coverage from different years is worth in today’s money:

Inflation Impact on Your Coverage

If you bought £100,000 coverage in:

- 2020: Worth about £82,000 today

- 2018: Worth about £78,000 today

- 2015: Worth about £71,000 today

- 2010: Worth about £63,000 today

What this means:

Your £100,000 policy from 2020 only has the buying power of £82,000 today. That’s a significant drop in real protection.

Most people don’t realize how much inflation has eaten into their coverage. A policy that seemed generous five years ago might barely cover basic expenses today.

Regional Cost Differences Across the UK

Where you live makes a huge difference to how much life insurance you need. Here’s how living costs vary across the UK:

Average Annual Living Costs by Region (2025)

Higher Cost Areas:

- London: £52,000/year

- South East: £45,000/year

- South West: £41,000/year

Lower Cost Areas:

- North England: £35,000/year

- Wales: £33,000/year

- Northern Ireland: £32,000/year

If you live in London, your family might need £52,000 per year just to maintain their basic lifestyle. But if you’re in Wales, £33,000 might be enough. This should factor into how much life insurance you need.

Why This Matters for Your Policy

Many people use online calculators that don’t account for regional differences. Our policy checker tool adjusts recommendations based on where you live, giving you more accurate results.

5 Common Policy Mistakes to Avoid

We see these mistakes all the time. Avoid them and you’ll be ahead of most people:

Mistake 1: “Set It and Forget It” Mentality

Your life insurance needs change as your life changes. Review your policy at least every 3 years, or whenever you have a major life event.

Mistake 2: Only Covering Your Mortgage

Your mortgage is just one expense. Don’t forget about other debts, living expenses, and future costs like children’s education.

Mistake 3: Not Comparing Prices

Insurance prices can vary by hundreds of pounds per year between companies. Always shop around, especially if your health has improved.

Mistake 4: Ignoring Inflation

A policy that seemed big 10 years ago might not be enough today. Consider policies that increase with inflation.

Mistake 5: Not Reading the Fine Print

Make sure you understand what’s covered and what’s not. Some policies have exclusions that could leave your family without protection.

When to Review Your Life Insurance Policy

Don’t wait for a crisis to review your policy. Here are the key times when you should take a fresh look:

Life Events That Require a Policy Review

- Getting married or divorced – Your beneficiaries and coverage needs change

- Having children – Kids are expensive and your coverage should reflect that

- Buying a house – Your mortgage protection needs to be adequate

- Starting a business – Your income and financial situation may be different

- Significant salary increase – Your family’s lifestyle expectations may have grown

- Health improvements – You might qualify for better rates if you’ve quit smoking or lost weight

Regular Review Schedule

Even if nothing major has changed, review your policy:

- Every 3 years – To account for inflation and changing needs

- When your policy comes up for renewal – This is a natural time to reassess

- After major economic changes – Like the cost of living increases we’ve seen recently

Pro Tip

Set a reminder in your phone to review your life insurance every January. Make it part of your annual financial health check, along with reviewing your budget and other insurance policies.

Take Action Today

Here’s the bottom line: if you haven’t looked at your life insurance policy in the past 2 years, there’s a good chance it’s not keeping up with your needs. The good news is that fixing this doesn’t have to be expensive or complicated.

Start by using our free policy checker tool at the top of this page. It’ll give you a clear picture of where you stand and what you might need to do next.

Don’t Wait

Every month you delay could mean leaving your family at risk. The sooner you check your policy, the sooner you can fix any gaps in your coverage.

Remember, the best life insurance policy is one that gives you peace of mind. You should never have to worry about whether your family would be okay financially if something happened to you.

Frequently Asked Questions

How much life insurance do I need?

A good starting point is 5-10 times your annual income. But you should also consider your debts, mortgage, and family’s lifestyle needs. Our policy checker tool can give you a personalized recommendation.

Can I increase my existing policy?

Many insurers allow you to increase your coverage, but this might require new health questions or a medical exam. Sometimes it’s cheaper to buy a separate policy.

What if I can’t afford more coverage?

Even small increases in coverage can make a big difference. You might also consider term life insurance, which is much cheaper than whole life policies.

How often should I review my policy?

At least every 3 years, or whenever you have a major life change like getting married, having kids, or buying a house.

Ready to Check Your Policy?

Use our free UK Policy Checker Tool above to see if you’re properly protected. Takes just 2 minutes.